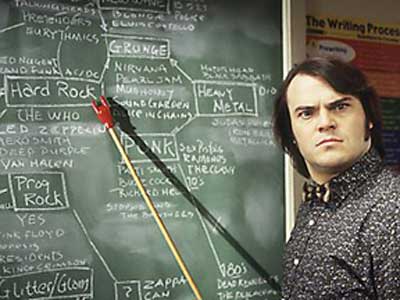

Education Selling

Pop quiz — is it easier to: (a) close a sale with a customer who already wants what you’re selling, or (b) sell to someone who’s not even aware they might want a product like yours, much less why they should buy it from you? Easy, right? Every day I meet entrepreneurs who beat their heads continue…