Tom Friedman’s op-ed today was a riff on Why Nations Fail, a new book from MIT economist Daron Acemoglu and Harvard political scientist James Robinson. Per Friedman, the core thesis of the book is the long-term instability of “extractive” as opposed to “inclusive” political and economic systems:

“Inclusive economic institutions that enforce property rights, create a level playing field and encourage investments in new technologies and skills are more conducive to economic growth than extractive economic institutions that are structured to extract resources from the many by the few.”

For anyone working in the “digital creative economy” — the weird little tribe of engineers, designers and venture capitalists that I count myself a part of — this thesis borders on the obvious.

Most of the people I interact with in the software innovation business take for granted the idea that the Internet is the global operating system for economic and political empowerment. No central power is viewed as unique or entitled to privileged status within this system — over the longer-term, companies (and even governments) are *expected* to rise and fall only to the extent that they attend to the needs of their users.

I’m sure many sophisticated players in the traditional sectors of the economy — and especially in the most extractive and politically entrenched sectors like financial services and energy — consider this idealistic view to be hopelessly naive.

Indeed, by historical standards, our government hasn’t been so in thrall to money interests — and so uninterested in the needs of the middle class — since the late 1890’s.

But the political upheaval now underway in the Middle East is powered by the same fundamental forces as the tech investment “bubble” thats drives the startup ecosystem in Seattle and Silicon Valley. In important and far-reaching ways, money and power have never been less important in the global economy.

The power to create — and to distribute that creation globally — is now in the hands of every human being on the planet with Internet access, more than 2 billion of us at last count. The current innovation cycle has layered on top of that basic plumbing an astounding array of tools that make every kind of digital expression — commercial, political or otherwise — more accessible than ever.

How long will it be before these forces begin to weaken the hold of the financial services industry over American politics? How many more damaging leaks will spring open in the murky machinery of money politics as a generation raised on Facebook and Twitter finds itself on the inside?

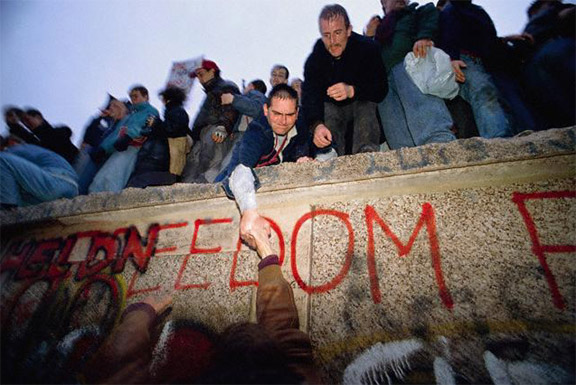

Call me a dreamer, but I see the writing already on the wall. They won’t go without a fight — and we’ll still have a generation of work wo do to fix the economic mess we’re in — but the distributed, transparency-seeking, individually-empowering Innovation Economy will break the stranglehold that big money has on power in America. And it will happen much faster than anyone thinks.