Last week I had several different conversation with entrepreneurs who are on the verge of setting up operations for their new startup. The topics we covered included:

- Should I self-fund / bootstrap or raise angel money?

- Should I accept an EIR / incubation offer from a VC firm?

- Should I keep looking for a technical co-founder or outsource early development?

- How much of my founder’s equity should I expect to share with co-founders and early hires?

- What would being accepted at a top-tier accelerator do for me that I can’t do myself?

There are no “right” answers to any of these questions. Hugely successful businesses have been built at all points on the spectrum, and — since companies are fundamentally a reflection of their founders’ values — the most important question is “what feels right to you?”

But founders also need to be aware that their answers to these (and other) questions have huge significance to prospective investors. I know I have a “right” answer to each of these, some of which I”ll outline below. That doesn’t mean that I’ll never invest in a company that chooses the “wrong” path, but it’s a significant hurdle for me to overcome in making a decision to invest.

I’m not the only investor who rules investments in or out based on early choices made by startup founders.

I’ve hugely enjoyed Blake Masters notes from Peter Thiel’s CS183 lectures at Stanford — if you haven’t read them I can’t recommend them more highly — and the notes for Class 6: Thiel’s Law cover this topic well.

A few examples of Peter Thiel’s investment heuristics (from that same lecture) are:

- Founders should be full-time / all-in

- Never hire consultants or contractors for important work

- No startup CEO should ever make more than $150K a year

- Every startup should be a Delaware C-corp

Again, many successful businesses have been built that violate some or all of these rules, but in Peter Thiel’s estimation, every decision you make that runs counter to this framework is a signal that your thinking and his are at odds. If you want his money, that should matter to you.

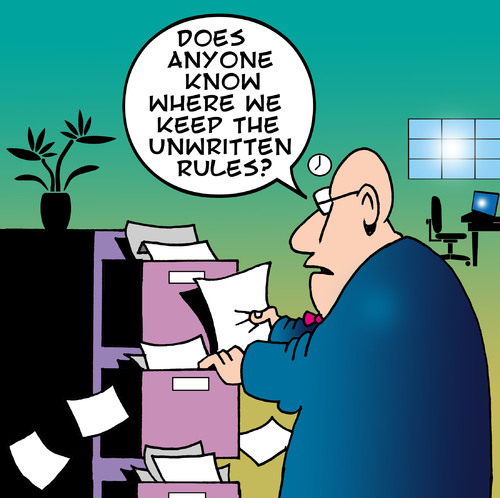

I’m sure there are skilled investors who disagree with Peter Thiel, but you can be sure that every investor has a set of heuristics and biases that she uses to filter investment opportunities, even if she’s not entirely aware of or explicit about them.

If you’re out looking for capital for your startup, you need to be aware of these biases and make decisions that are congruent with the kind of capital you hope to raise.

If you want to raise money from Founders Co-op, here are some of our biases that you should be aware of before you come in to pitch:

- We’re “maker-centric” — we’re heavily biased toward founding teams that are more engineers + designers than businesspeople, with a track record of building beautiful, useful software both within and outside their day jobs.

- We’re wary of solo founders — the atomic founding team is at least two people, ideally a hacker and a hustler. Both can be devs, and three or more is OK, but one is a worrying number.

- We don’t believe winning products get built by outsourcing / offshoring — makers who listen to customers and improve at lightning speed will always beat spec-driven development, and all the selling in the world can’t fix a shit product.

- We like founders with huge dreams + the skills to back them up — building any company is brutally hard work, so pick a fight worth winning and build the best team you can — investors included — to play in the big game.

- We view attending a tier-one accelerator as a no-brainer based on signaling value alone — even before you get to the mentorship, the alumni network or the investor intros, being selected by Y Combinator or TechStars is such a powerful positive signal to the market that you’d be crazy not to take it, especially in a world of near-perfect competition for software ideas.

These aren’t rules, they’re biases — we always reserve the right to break them if we find something else about the deal to love — but they’re a hurdle to jump over. And there are plenty of other things we take into consideration when we’re evaluating a company for investment.

But for founders with an interest in raising money — never forget that *everything* you do has signal in it for investors. In the investing world the default answer is always “no”, so try not to make choice that will get you a “no” before you’ve even opened your mouth.